VisionFund View

VisionFund Thought Leaders

Boosting financial access amidst the climate crisis

The climate crisis is the greatest threat to human health in the 21st century. This threat is particularly true for women and girls, who face higher risks...

Read more

Agriculture has always been the lifeblood of Uganda's economy, with smallholder farmers constituting the majority of its working population. However, in...

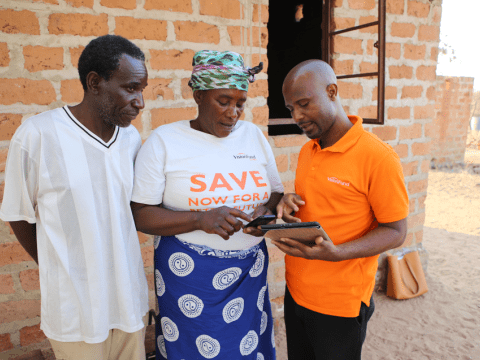

Written by Miyon Kautz, Director, Marketing and Engagement, VisionFund “Love your neighbour as yourself” ( Lev. 19:18 ). Lazarus Chama, a Branch Manager of...

On International Day of the Girl Child, Kaitlin McGarvey, North America Fundraising Manager of VisionFund International reflects on the impact of access to...

By Dr. Jean Baptiste Kamate, Chief Field Operations Officer for World Vision International and Board Member for VisionFund International Our work in...

Written by Kaitlin McGarvey, North America Fundraising Manager, VisionFund International “I want the business to become a one-stop shop for anything needed...

Written by Johanna Ryan, Global Director of Impact, VisionFund International In our work, there are significant challenges to producing evidence of the...

Written by Kaitlin McGarvey, North America Fundraising Manager, VisionFund International Breaking the Bias: VisionFund Staffing VisionFund is committed to...