Finance 4 Employment (F4E)

Finance 4 Employment (F4E)

Micro, Small and Medium Enterprises (MSMEs) in developing countries are often left behind in the financial services market, deemed too small to lend to, yet too large for traditional microfinance. VisionFund is pioneering new ways to support the growth of MSMEs. Since the program commenced in 2016, over USD $4.3 million has been disbursed to over 1,250 MSMEs in Myanmar, Ghana, Mexico and Sri Lanka, and over 65% of our existing 961 MSME clients are women-led enterprises.

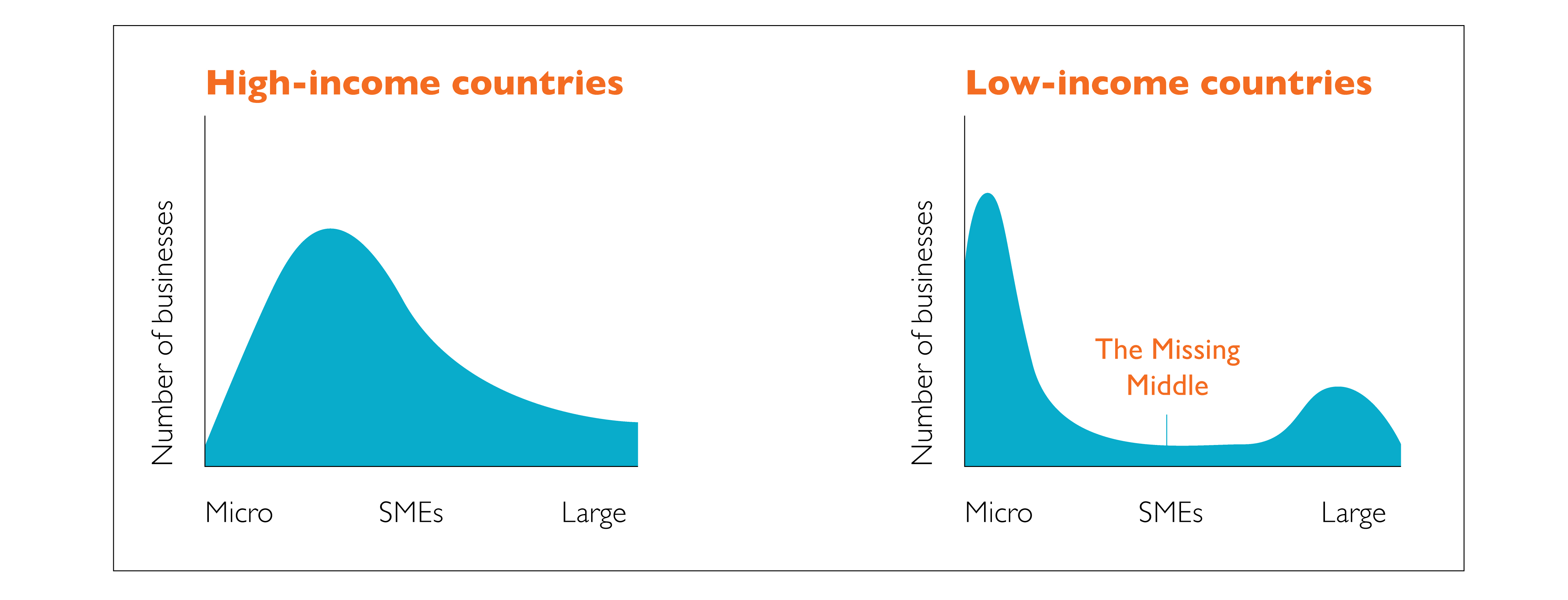

The Missing Middle

MSMEs are enterprises on a growth or formalisation path that often employ five or more employees, and ideally facilitate local trade flows, stimulating the economy in their communities. Despite their significant contribution to GDP and employment generation within developing countries, there is a critical lack of suitable finance globally to enable MSMEs to grow. Many MSMEs have outgrown microfinance, but are unable to access larger, formal finance from banks or other finance institutions. Barriers to accessing appropriate finance can include relatively small loan size and associated high operational costs, geographical remoteness, lack of collateral to guarantee credit, and poor financial record-keeping. This credit gap is known as the ‘Missing Middle’ and is valued at over US$2 trillion globally for MSMEs according to the SME Finance Forum.

Read more about our Most Missing Middle Project:

In low-income countries, small and medium enterprises are left behind without access to finance.

Source: Asim Khwaja Center for International Development at Harvard University

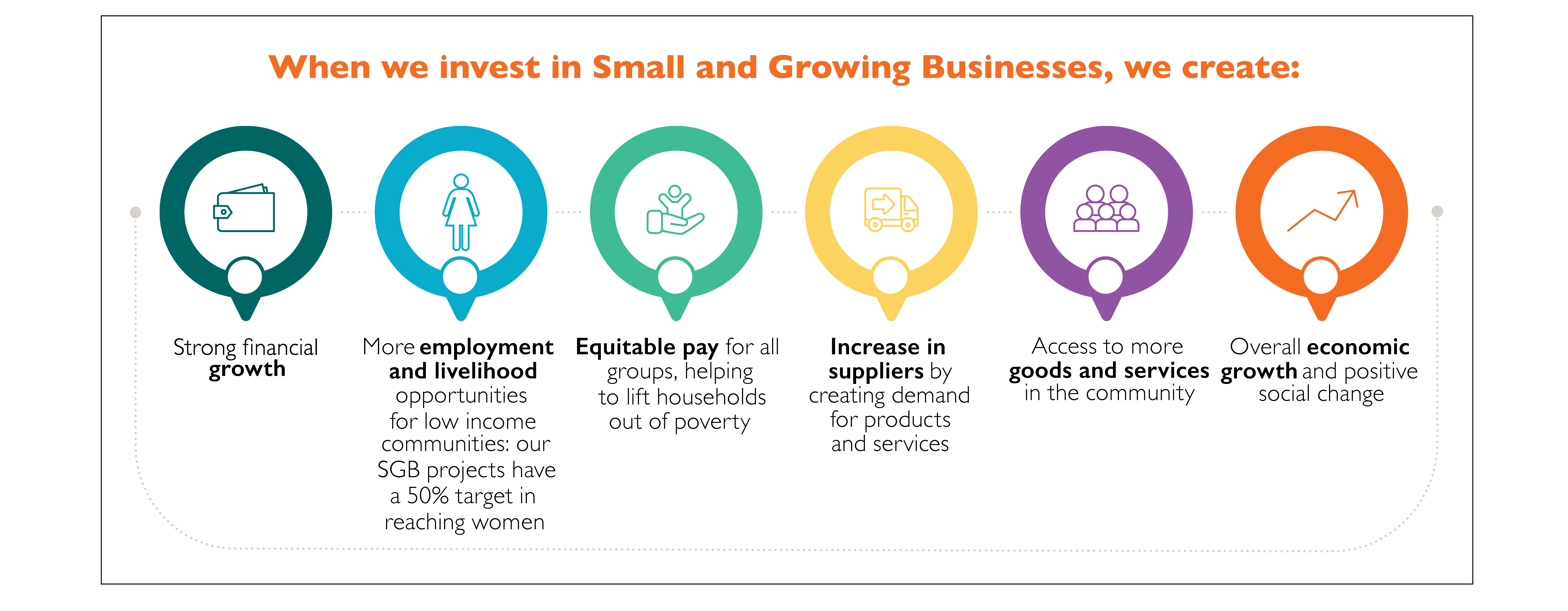

Small and Growing Businesses

To address this issue, VisionFund is building on existing microfinance and economic development programming.

By supplying a loan size beyond traditional microfinance limits – between US$2,000-$25,000 - VisionFund can ensure that MSMEs are able to expand their growth, take on new employees and spread economic opportunity. In 2016, VisionFund Sri Lanka began testing the financing of loans between US$3,500-$25,000, in order to reach the most missing of the ‘missing middle.’ VisionFund has since expanded this product to Myanmar, Ghana and Mexico and has added a business advisory component within the F4E product through one-on-one business coaching for business owners. This tailored business coaching to our MSME clients helps to accelerate sustainable and responsible business growth. As these MSMEs grow, they create jobs for low income communities, multiplying the impact for families and children living in poverty.

How Our SGB Programme Works

VisionFund identifies high potential enterprises – either through its own pool of microfinance clients or in the local community – who need larger F4E loans to fuel the continued growth of their business.

Once the MSME has been assessed as needing an F4E loan, VisionFund loan officers work with their clients to submit the loan application and also introduce the client to the Business Model Canvas (BMC). The BMC is a tool that VisionFund uses in tailored, one-on-one business coaching sessions with SGB clients. As well as setting tangible goals for the growth of their business, the loan officer works with the MSME owner to identify options for overcoming growth challenges and helps to assess the suitability of different courses of action. Over time, the F4E coaching helps the clients to make smarter, more informed decisions that can improve the growth, inclusiveness and sustainability of their business. The business coaching commences once the loan is approved and continues on a regular basis until the loan is repaid, or continues on if the loan is renewed.

Building Evidence

Through this innovative F4E product, VisionFund is building evidence to demonstrate to the wider market that lending to MSMEs, and providing business coaching, is delivering impressive results for low income families and children.

When we support one MSME to grow, we not only support the business owner and their family, but the families of the employees, and whole community around them - that's why we call our program Finance 4 Employment. We’re taking action to prove that lending to MSMEs is financially attractive, economically sustainable, and delivers considerable social impact.

Responding to COVID-19

All the MSMEs that VisionFund supports are in contexts affected by the COVID-19.

In Ghana, COVID-19 has led to 88% of clients reporting a loss of income, with 57% reporting a loss of demand for products and services while lockdowns have been in effect. For MSMEs, a loss of income can have substantial flow-on effects outside the MSME itself – from impacting the income and livelihoods of MSME employees, to reducing the availability of necessary goods and services in the community.

Through VisionFund’s business coaching services, MSME have been encouraged to use their resources to pivot towards resilient products and services, such as manufacturing masks, health equipment and food. VisionFund is also re-scheduling and restructuring F4E loans, organising repayment pauses, approving reductions in loan disbursements and planning for provision of recovery loans where required to assist businesses to manage cash flow crises. We are also moving program delivery to online and phone services, to minimise the spread of the virus whilst supporting clients through the immediate threat.

The Most Missing Middle Project

In Myanmar and Ghana, the Most Missing Middle project is delivering innovative finance for Micro, Small and Medium Enterprises (MSMEs). VisionFund is proud to deliver the project in partnership with the Australian Government (DFAT’s innovationXchange and Aid4Trade), World Vision Australia, and also supported by the Shapansky Foundation.

Financing Small and Growing Business

An assessment of Small and Growing Business Finance Project in Ghana and Myanmar.