Our History

Our History

Unlocking economic potential for communities to thrive

VisionFund Celebrating 20 Years of Financial Inclusion through Microfinance

Our History

Since 2003, VisionFund has been committed to brighter futures for children where girls and boys can experience the love of Christ, building lives free of need and full of promise.

Our financial services enable impoverished households to increase their incomes and then impact communities to increase economic activity, access clean water, education and healthcare, benefit from improvements to nutrition, and provide the foundations for local economies to flourish. God is there—and we are there too. So, our mission continues.

World Vision Partnership

VisionFund works alongside World Vision in their Area Programmes, as much as possible, delivering multi-sectoral solutions to build community resilience. Our pathway of change is based on the principle that by working together we can have greater impact than working alone.

Because VisionFund’s financial services are designed to be self-sustaining, VisionFund continues to supply financial services as long as there is need and demand in communities. This means that VisionFund provides continuity of impact even after World Vision has completed its work and closed the Area Programme. VisionFund also works outside Area Programmes where individuals and communities need microfinance to support their livelihoods to increase community resilience.

FOUNDATION OF WORLD VISION INTERNATIONAL

1950

Bob Pierce founded World Vision three years after he came face to face with an abandoned child and chose not to look away. Determined the last $5 in his pocket wasn’t enough, he knew more people had to be involved for a long-term solution and broader impact. Initially based in the state of Oregon, the organisation focused on missions service for emergencies in East Asia. Today World Vision has become the largest Christian international non-governmental organisation working in nearly 100 countries worldwide.

20 Year Milestones

2003

VisionFund International was established by World Vision as a wholly owned subsidiary to oversee World Vision's microfinance work.

2003

Christopher Shore was VisionFund's founder and appointed CEO to manage and bring into alignment World Vision's microfinance institutions in 43 countries.

2004

World Vision International makes the first loan of $10 million to VisionFund International to fund the expansion of lending capital to our MFIs.

2005

World Vision developed its first global strategy for Economic Development. The strategy called for investing in Savings Groups, and with respect to our large-scale efforts, to focus first on microfinance – building the financial, systems, and human capacity of MFIs to reach all of the places World Vision serves.

2006

Scott Brown appointed as President and CEO for VisionFund International.

2007

VisionFund reaches 530,000 clients.

2010

With over 200 submissions, VisionFund AzerCredit in Azerbaijan, was the sole MFI to receive the gold award for social performance reporting. Dedicated to developing innovative social performance programmes, VisionFund AzerCredit was recognized by MIX for its integrity and transparency in reporting, measuring, and data collection of social performance. Social performance reporting allows VisionFund AzerCredit to better target the poor and design appropriate products and services.

2013

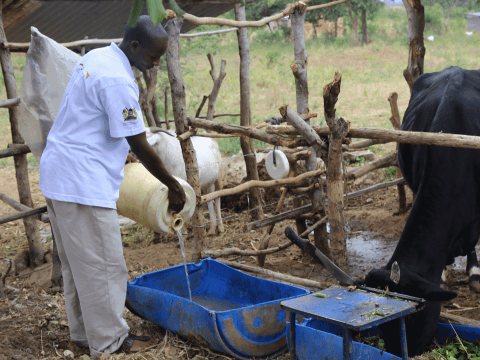

Securing Africa's Future is an initiative from World Vision and VisionFund to help build the resilience of farming communities in East Africa. Farmers are the key to ensuring their families and communities have enough food, whilst improving their rural livelihoods and protecting the natural environment in Africa. When farmers can mitigate their own risks and manage their own shocks, then the impact of any environmental, economic or political change is severely reduced. Our aim is to help farmers become independent and economically secure, so they can look after their families and invest in their community.

2013

VisionFund Tanzania launches mobile banking. Three quarters of the Tanzanian population live in rural areas, but only 8% have access to financial services. The new mobile service offered by VisionFund will give more people access to essential banking needs, allowing them to grow businesses and livelihoods to support their family. Mobile banking was subsequently launched in Uganda, Zambia (2017) and Rwanda (2018).

2014

VisionFund reaches the milestone of serving one million clients. Annakili was the millionth client and took out a US$150 loan and purchased a pregnant goat which she plans to breed.

2014

Working alongside the World Vision Typhoon Haiyan Response Team, VisionFund pilots its ‘recovery lending’ programme to help affected clients quickly resume work to earn a living to support their families, in turn stimulating economic development of the wider community.

2015

Enhanced credit life insurance is launched by VisionFund Kenya with additional benefits of sickness, maternity and coverage for family members. This standard of coverage is also made available in Malawi.

2015

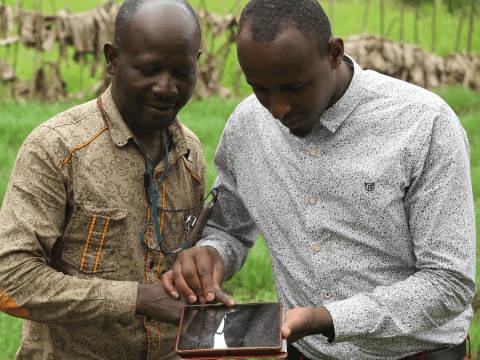

In addition to Tanzania, tablets were subsequently introduced for loan officers to use in Cambodia and Malawi (2018). The tablets allow the loan officers to conduct faster client registration and assessment in addition to enabling better data management for the microfinance institution which results in better understanding of clients and faster processing times. In 2019, VisionFund Lanka will pilot the use of tablets for their loan officers.

2016

THRIVE was launched in Malawi and Zambia in 2016 and later in Rwanda and Honduras (2017). The programme carries on the work of foundation project Securing Africa’s Future and brings smallholder farmers together into groups to save and to learn better and more effective farming practices.

2016

Together with World Vision Canada, World Vision Australia and with seed funding from the Australian Government and Canadian donors, VisionFund launched its lending programme helping small businesses to grow in Sri Lanka by providing loans of US$4,000 to US$25,000 alongside ongoing business coaching. VisionFund’s Small and Growing Business (SGB) lending programmes have since expanded to supporting entrepreneurs in Ghana, Mexico and Myanmar.

2016

VisionFund received the award for its ‘recovery lending’ programme following Typhoon Haiyan in the Philippines. Loans were made to support faster economic recovery for clients through enabling the purchase of income earning assets such as fishing boats without creating over-indebtedness.

2016

Innovative Group Multi-Peril Crop Insurance started with VF Tanzania in Kasulu, as part of a wider programme to be implemented, initially in Africa. Currently operating in Tanzania and being piloted in Kenya and Malawi.

2016

Launch of the Women’s Empowerment Fund, a bold vision to contribute to VFI’s target of empowering two million women and impacting six million children annually by 2021. The Women’s Empowerment Fund aims to build the resilience of women and their families, improve gender equity and support the development of women’s livelihoods by expanding financial access for women and delivering quality credit, savings and insurance products developed by VisionFund with women, especially mothers, in mind.

2017

Livestock and small asset insurance was launched in Kenya and Tanzania, with a subsequent programme in Zambia in Summer 2018.

2017

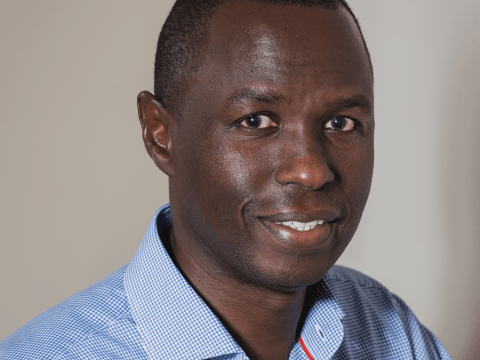

Michael Mithika named President and CEO of VisionFund International, moving from Nairobi to London. Mr Mithika stated that he was excited to join VisionFund, “Economic empowerment is a vital key in unlocking potential in the global economy and assisting the most vulnerable families. VisionFund is at the forefront of using innovation, including technology and disaster recovery programmes, to build capacity in the most difficult to reach rural environments. It is a privilege to be part of deepening World Vision and VisionFund’s impact around the world.”

2018

The ARDIS programme is thought to be the world’s largest non-governmental climate insurance programme. It protects the microfinance institutions against catastrophic hazards and enables funding of recovery lending programmes post-disaster to help clients and their families resume their livelihoods. Launched in:

- Kenya, Malawi, Mali, Zambia, Cambodia and Myanmar.

- With 80% women clients.

- 4 million beneficiaries.

2018

With Cambodia’s economic development and wide availability of access to microfinance, VisionFund sold its operations in Cambodia to move its resources to assist more vulnerable populations with less access to financial services. VisionFund Cambodia served:

- Over 90% clients were women.

- 87% were in hard to reach rural areas.

- 59% were in the agricultural sector.

2019

VisionFund International announces it has raised AUD20 million with its first bond issue. The funds raised from the bond issue will be used by VisionFund to on-lend to and grow its microfinance institutions which complement World Vision’s economic development work.

The bond is being arranged by FIIG Securities Limited (FIIG), Australia’s largest fixed income specialist and represents FIIG’s first foray into impact investment.

2020

VisionFund Uganda is the first microfinance organisation to have established a branch in Moyo to serve the Palorinya refugee settlement, a remote part of Uganda home to over 121,000 refugees and over 48,000 Ugandan nationals. VisionFund plans to bring financial services to the refugees at scale and will open a further three branches in 2020 with the second branch planned in the coming months in Yumbe district to serve both Yumbe town as well as the Bidibidi settlement, one of the largest refugee settlements in the world, home to over 230,000 refugees.

2021

Edgar Martinez named President and CEO for VisionFund International.

Reflecting on his journey, Edgar shared, “I’m humbled and honoured to have the opportunity to lead and work with a team of 7,400 VisionFund professionals in 28 countries that together seek to fulfill the mission of improving the lives of children and families living in vulnerable communities by offering financial and livelihood solutions."

2021

Ghanaians and Malawians without a formal relationship with financial services will be able to access Accident, Sickness and Health insurance products for the first time thanks to the Swiss Capacity Building Facility (SCBF), in partnership with microfinance network VisionFund International and its parent, development NGO World Vision.

2021

VisionFund announced that it has successfully issued its first notes from Eventide Asset Management, LLC and expects to issue up to USD $37 million of notes from Eventide.

VisionFund’s strategic ambition is to support 10 million clients and impact 30 million children’s lives by 2030. Through the partnership with Eventide, VisionFund will provide financial solutions to more vulnerable small business owners living in rural areas where VisionFund operates.

2023

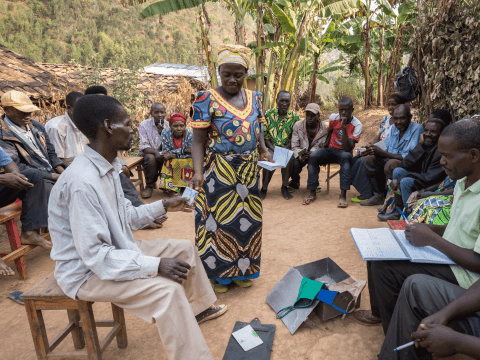

VisionFund and World Vision are partnering with DreamStart Labs to accelerate the digitization of savings groups worldwide and give members easier and faster access to microloans and microinsurance.

Over the next six years, World Vision intends to establish more than 130,000 new savings groups with access to digital ledgers via the DreamSave app. This represents one of the largest expansions of digital savings groups in history, bringing award-winning digital financial services to 3 million previously unbanked and excluded people in rural communities; the target will include the goal of reaching 85% women.