VisionFund Myanmar Financial Inclusion Practices Report

After performing more than 300 in-depth interviews with VisionFund Myanmar clients, the independent data-led social enterprise 60 Decibels published a new report comparing VisionFund’s financial inclusion practices with 52 other companies working with 60 Decibels’ Financial Inclusion Benchmark score.

The report found that VisionFund Myanmar performs particularly well where 90% of surveyed clients use their loans directly to invest in their business, whilst 93% reported increased income as a direct result of a VisionFund loan. Of particular note in 2020 is that 66% of surveyed clients reported an improved ability to reduce the impact of COVID-19 on their families and businesses, due to VisionFund’s support.

60 Decibels set out to answer five key questions for VisionFund Myanmar:

- Who is VisionFund Reaching?

- What Impact is VisionFund Having?

- What is VisionFund’s Impact During COVID-19?

- Are Clients Satisfied with VisionFund and Why / Why Not?

- Does Impact and Satisfaction Vary by Gender?

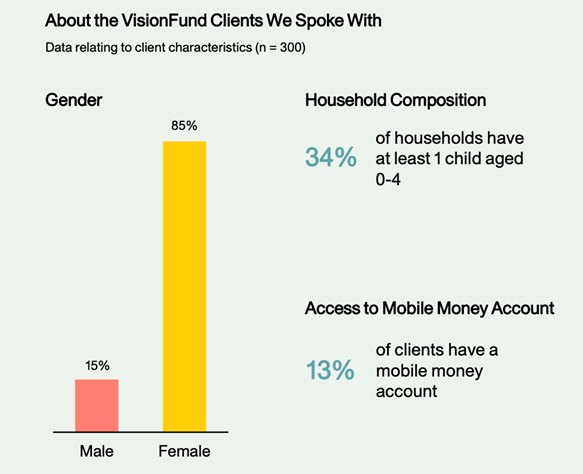

85% of clients 60 Decibels spoke to were female, with 34% of surveyed households having at least one child aged between birth and four. 88% of these clients are living on a maximum of $11 a day, with 17% below $3.20.

Clients surveyed said they rarely use their loans to cover personal expenses, such as home improvements and school fees; instead, 33% of clients said they used their loans to purchase stock and inventory for their businesses. 40% of surveyed clients mentioned a greater ability to invest and grow their businesses, with a further 20% citing improved savings ability.

“My house has improved. I can save money and make donations. My motivation has also improved, and I have an objective for my son’s future education,” said one client.

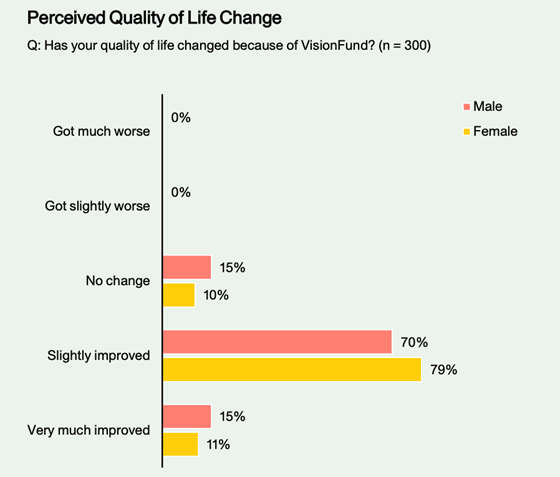

When it comes to seeing impact on gender, almost 70% of both female and male clients said their active contribution in important family decisions had increased, and more than 75% said their confidence had increased. A slightly larger number of women than men reported an improved quality of life since taking the loan, at 90% rather than 85%.

Clients have consistently identified longer repayment terms, reduced interest rates, and higher loan amounts as aspects of their loans that they would like to see improved. In response, and particularly through COVID-19, VisionFund Myanmar has implemented a range of changes to their loan portfolio performance, including helping families to access their compulsory savings much faster, as well as deferring loan payments where required. VisionFund Myanmar also has a Small and Growing Business program, to offer larger-scale entrepreneurs a greater amount of credit and business training to develop their operations and even take on more employees.

VisionFund Myanmar was also pleased to see that 56% of surveyed clients identified themselves as active ‘promoters’ of VisionFund’s services, citing low interest rates, a flexible repayment system and friendly staff as the reasons they share VisionFund’s details with others. “VisionFund has a fair interest rate and a good system for repaying the loan,” said one client.

Moving forward, VisionFund Myanmar CEO Mike Spingler said, “This report confirms many of our approaches and beliefs and provides the roadmap for improvements for customer service, products and lifetime relationships. We are now better prepared to meet our client needs and deliver quality COVID-19 responsive services.”