VisionFund Africa's response to COVID

Written by Ljiljana Spasojevic, Regional Head Africa for VisionFund International

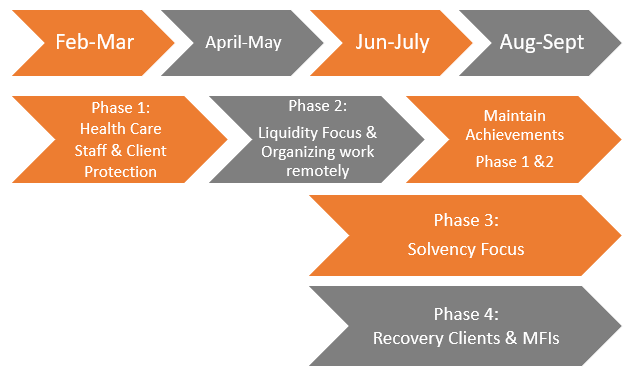

The Africa region was hit by COVID-19 later than Asia and Europe, with the first cases and first country measures starting to appear in late February 2020. This equipped the Africa Regional team with knowledge and experience from other regions, and we reacted quickly to prepare our Microfinance Institutions (MFI) and clients to respond to the COVID crisis. The Africa region at VisionFund adopted a phased approach to handling the crisis.

In Phase 1, our focus was on ensuring the protection of staff and clients, and on raising awareness on the health implications of COVID-19 and issuing guidance on how our staff and the communities they serve can stay protected.

In April, our focus moved to securing our liquidity reserves, and organising work remotely. During March and April, many countries where VisionFund works introduced restrictive measures on movement through partial and complete lockdowns, and restricted economic activities.

In the second phase, VisionFund paid special attention to speeding up the implementation of mobile banking solutions in West Africa. Mobile banking solutions mean that clients do not have to leave their homes to access loans and receive savings, making our operations more COVID-secure.

In the third phase, as some countries started to relax their lockdown measures, our teams increased our loan collection efforts and shifted our focus to solvency. In order to minimise losses, VisionFund introduced a new set of measures to increase efficiency and decrease operational costs. Parallel with our cost reduction activities, we started to explore new revenue streams such as new insurance products and cash transfers.

Now that we are in the recovery phase in September 2020, we are focusing on our clients’ - and our own - business recovery. We are exploring new business models in the MFIs which have been most affected by the COVID crisis.

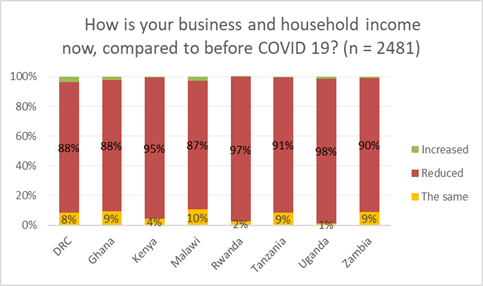

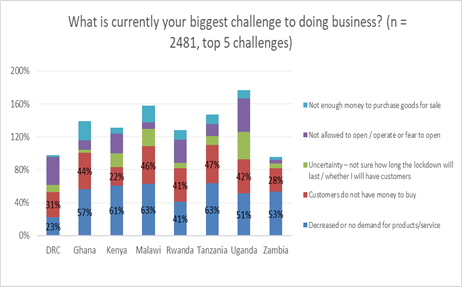

Where clients’ business recovery is concerned, our MFIs are making a significant effort to learn exactly how clients have been affected by COVID-19 measures and how their business, family dynamics and needs have changed. In May we conducted market research activities through more than 2,500 client interviews in eight countries. Based on our research, and other data collected during the COVID crisis supported by our product development team, we developed several solutions and recovery loan products for our clients, to help them build back better.

Effect of COVID-19 on Clients

Our market research data indicates that approximately 90% of clients experienced a decrease in revenue. Besides an inability to work due to restrictive measures, clients indicated that their biggest challenge on average is the decrease in demand for their products, or not having enough money to restart business cycles.

Effect of COVID-19 on MFI Performance in the Africa Region

COVID-19 is a serious health issue, but it has also driven major economic disruptions to almost all sectors. In Africa, the intensity of the economic crisis does not depend on number of COVID-19 cases, but rather directly correlates to the restrictiveness of the country response. The biggest effect on MFIs performance is observed in Uganda, Rwanda and Kenya; these being countries which had the most restrictive measures. On the positive side, the COVID-19 crisis has forced VisionFund’s African operations to be better in our business: we sped up with digital and mobile solutions, we became more flexible and faster in product design, and we learned how to work remotely. The COVID-19 crisis forced us to explore more efficient business models and structures in many of VisionFund’s MFIs in Africa.

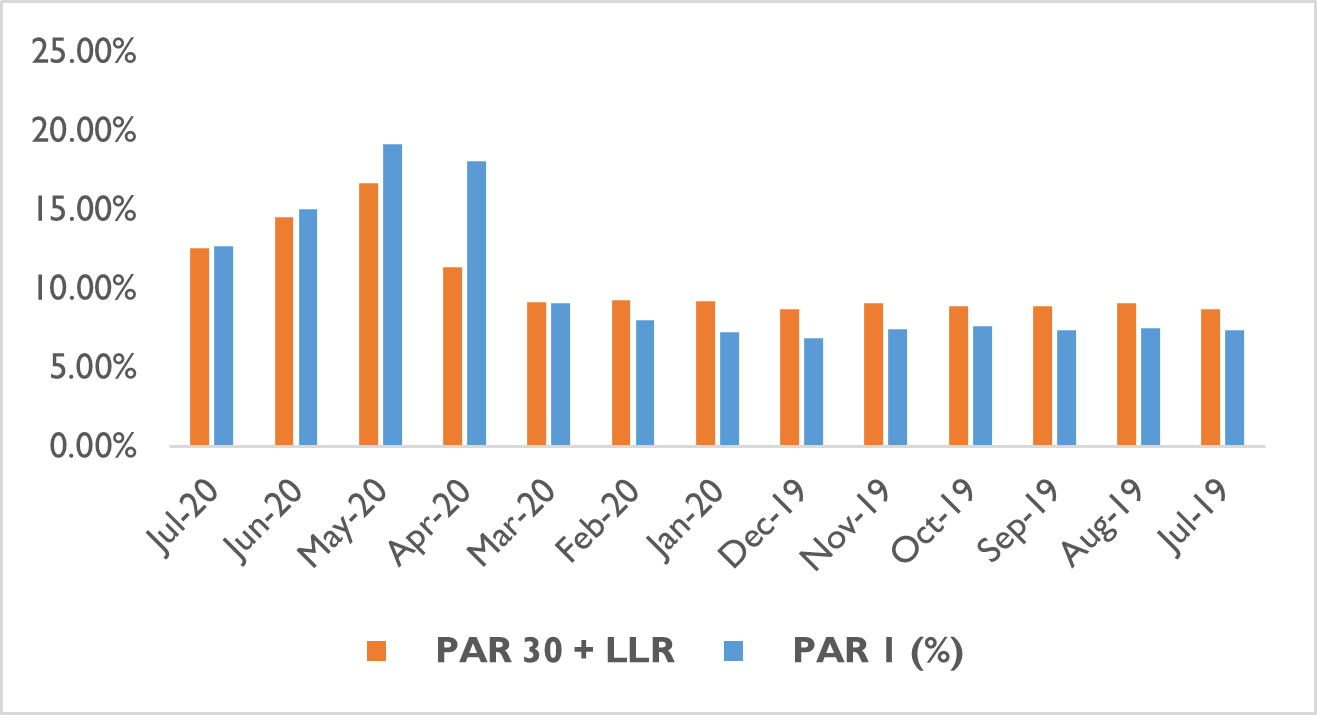

The main effect of COVID-19 on our business is worsening of portfolio quality, followed by increase in provisioning and decrease in net revenue.

As the future development of the COVID-19 crisis in Africa is unknown, VisionFund continues to monitor the situation in each country. In the majority of African countries in which VisionFund works, there is no reliable evidence on the spreading of the virus, mostly due to the insufficient testing (with the exception of Ghana). Additional challenges in some regions include natural disasters, such as the flooding season and locust invasion we experienced in East Africa, as well as a prolonged drought period in South Africa. We are also seeing some political instability in several countries.

Despite all the uncertainty, the Africa Team is remaining optimistic. We have stopped approaching COVID-19 as a crisis and have begun integrating its reality into our lives and business. VisionFund has gained additional confidence, because we have started to see the first signs of performance improvements in July and August. We are confident that with new solutions and recovery lending products, we will be able to help our clients to recover their businesses and revenues.