Expanding our Cashbox: Piloting Savings Group Linkage

By Karen Lewin, VisionFund International

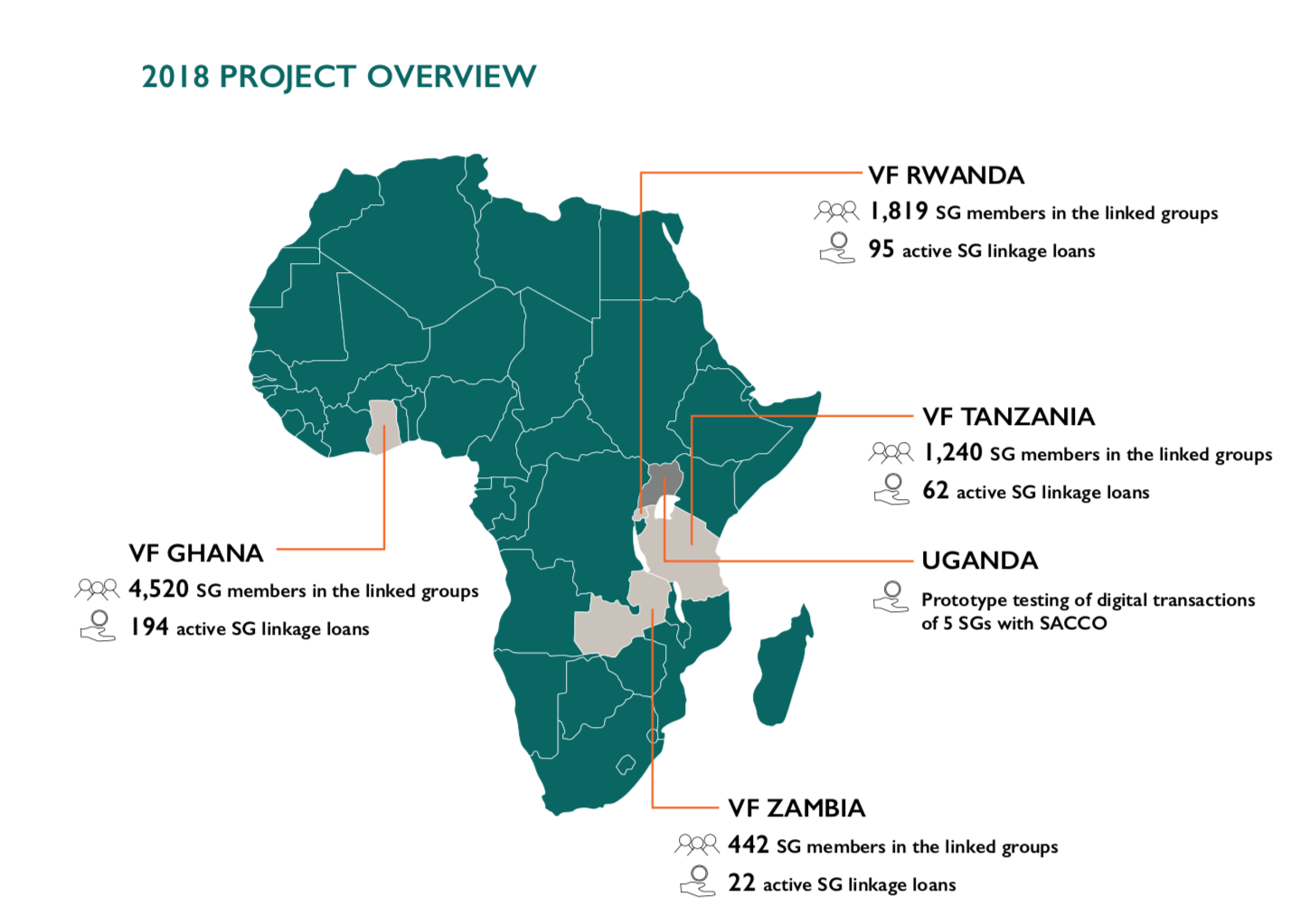

Since 2014, VisionFund has been working on ways to support community savings groups through new lending practices, allowing communities to grow their economic activities. Pilot tests were conducted in Tanzania, Rwanda, Ghana and Zambia, plus a Triple Jump pilot in Uganda in partnership with impact investor Triple Jump, with 373 saving groups with linkage loans since December 2018. VisionFund recently evaluated the results of the pilots in collaboration with Triple Jump, with exceedingly promising results.

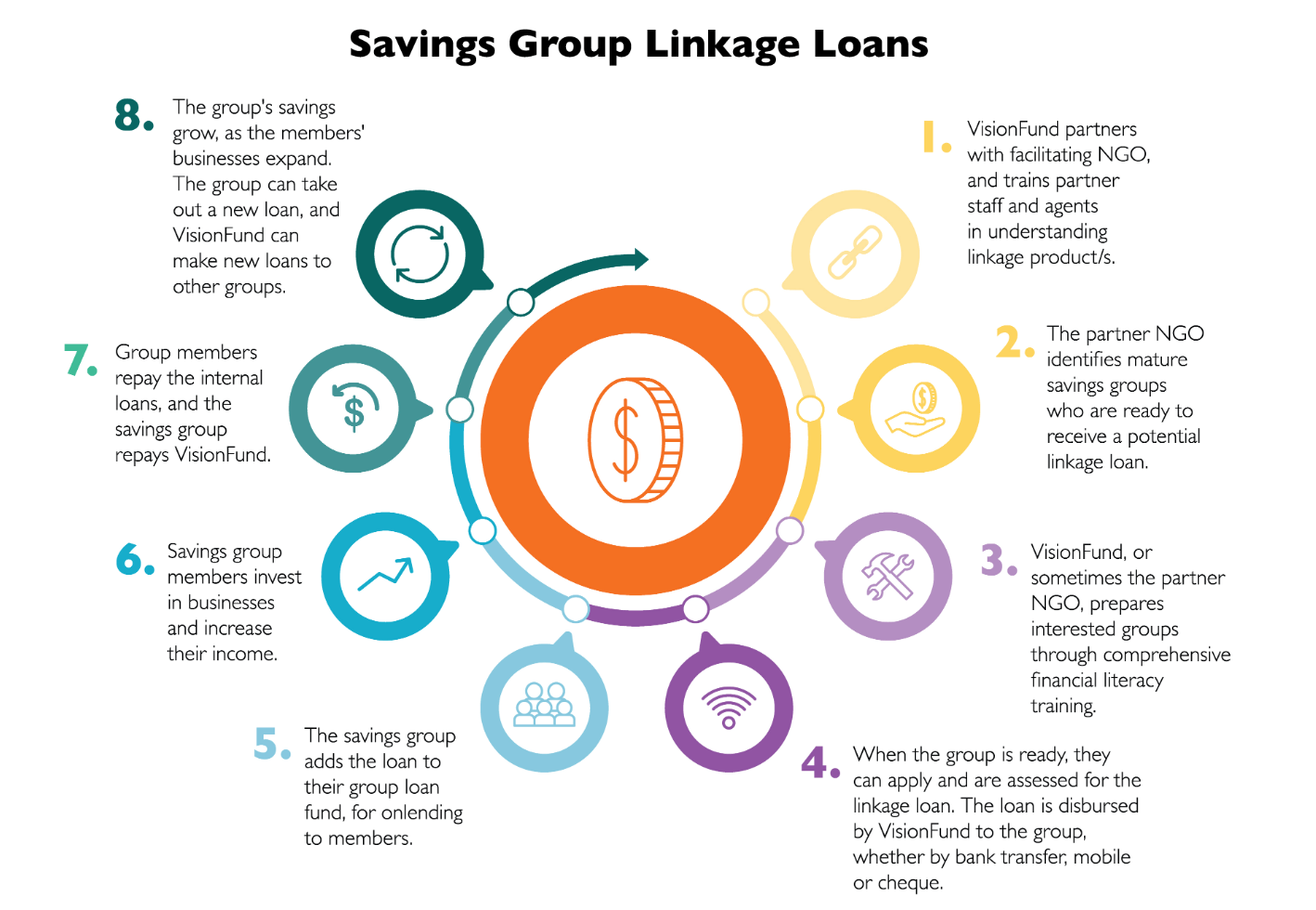

A savings group linkage loan is credit offered by a ‘formal’ financial institution (typically a microfinance institution or a local bank), to the group. It is disbursed into the group fund of the savings group, rather than to individual members, and is managed by the savings group according to their normal lending criteria and processes. There is no collateral, compulsory savings, or household cashflow assessments; the financial institution assesses the group’s capacity for this loan, typically on the basis of the group’s last share-out and achievements, such as whether internal loans were repaid, how much members save, whether the group retains members from cycle to cycle. It differs from a regular microfinance group loan, which is a loan to a client, for a specific amount and term, often guaranteed by other borrowers in the group.

There are over 750,000 saving groups worldwide, and most of these groups transact via cash. A growing percentage have a bank account, but only a handful have accessed a savings group linkage loan, which is where VisionFund has identified a gap in the market. Linking savings groups to a bank or microfinance institution can enable the group to add to the group fund to meet members’ demands for more loan capital to expand their business (credit), and to save excess cash in the box safely (savings accounts).

In 2017, VisionFund began reviewing the savings group pilots, successes and next steps, and sought Triple Jump as a partner to conduct market research, product development, a pilot and external evaluation. The goal was to ensure the savings group linkage had greater customer focus and sustainability. Triple Jump partnered with VisionFund to pilot a new approach to savings group linkage in VisionFund Zambia.

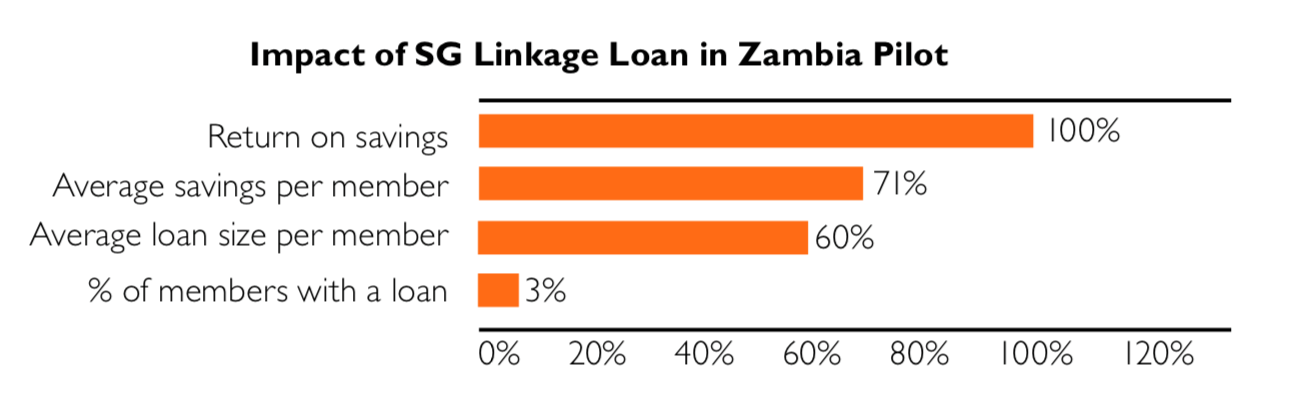

Market research was conducted among World Vision Zambia savings groups totalling 138 members in 41 groups. As a result of the research, VisionFund Zambia launched a new product in 2018, piloted among 22 savings groups from World Vision and the World Food Programme. The pilot was then evaluated by a Triple Jump consultant through 21 focus group discussions with 112 women and 33 men.

Some exciting findings came from the pilot in Zambia:

In addition, other measured benefits from the pilot assessment included:

- Average savings per member among profiled groups increased by 71%, from a mean of $143 to $251.

- Average loan sizes increased from $40 to $64.

- Return on savings increased from 7% to 14%.

- Percentage of members with outstanding loans increased from a mean of 74% to 77%.

- Groups reported that the debt was manageable – there was zero portfolio at risk or write off in the pilot, which is exceptional in the operating environment.

- The pilot was also successful in reaching women: 75% of members were women, again higher than that of the MFI’s overall portfolio.

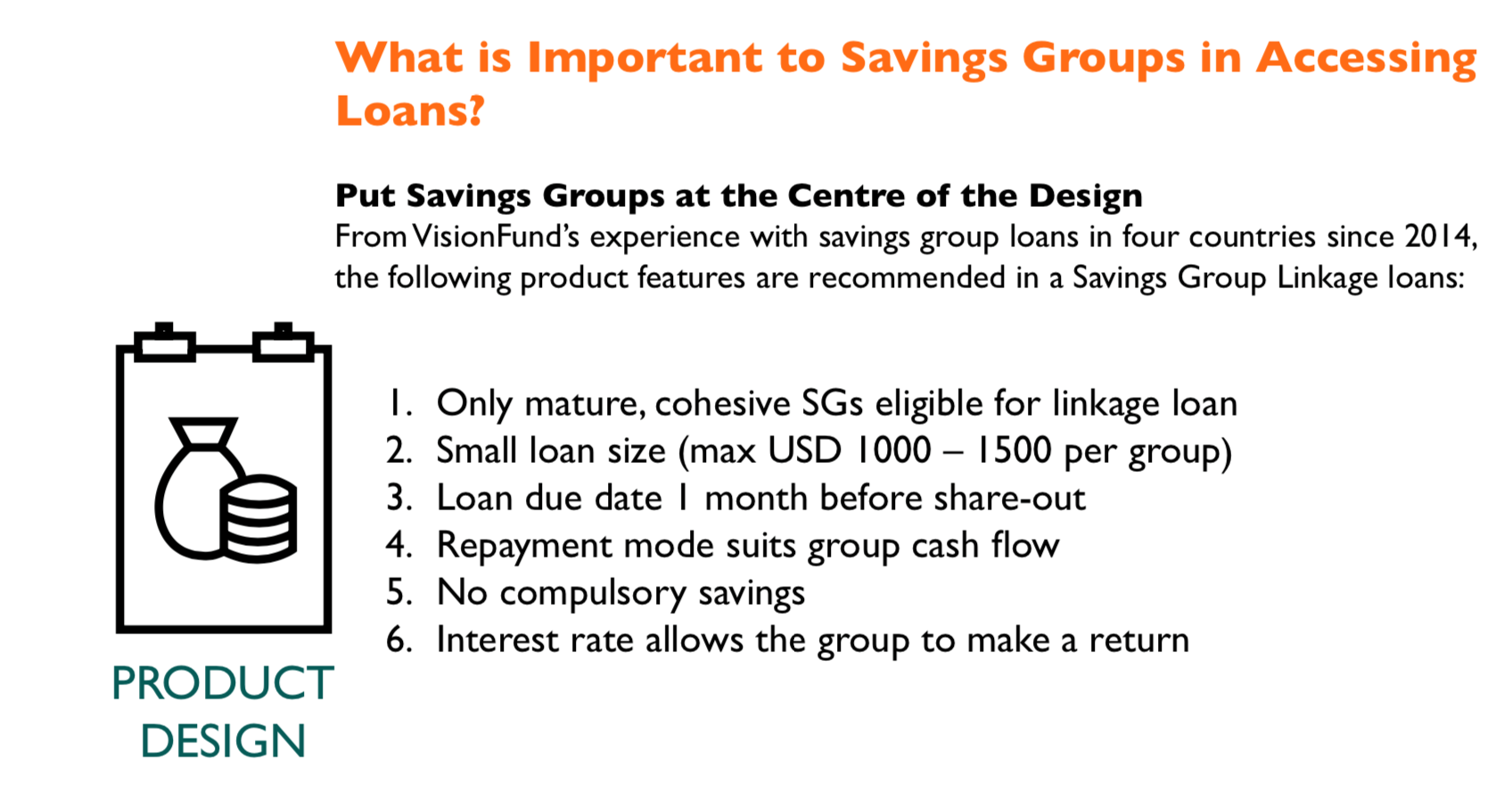

For VisionFund, the key success factors in linkage loans are working first with a partner, having a well-defined product and process which staff are trained in, lending to cohesive, mature groups, not lending too much, and having a pathway for members needing larger loan sizes. Taking the needs of savings groups into consideration was central to the product design and will continue into all future savings group linkages.

The other solution for more sustainable linkage of savings groups is digitisation. This is where savings groups make their transactions through a mobile phone, linked with a mobile money provider, rather than with the cash box. The groups can readily access a financial services provider through an interface of the mobile application and the financial service provider’s IT system.

In the scale-up of the pilot, VisionFund will seek to reach more than 2,100 groups with 36,100 individual members with our formal Savings solution to improve efficiency and security for savings groups in Zambia. In addition, VisionFund is looking to offer complementary credit to groups who sign up to the digital solution.

Read the full report: Expanding our Cashbox: Linking Saving Groups to Financial Services

Find out more about our Savings for Transformation and Microfinance project models.

Listen to the webinar recording on Expanding our Cashbox: Linking Saving Groups to Financial Services

Join us at the SG2020 conference to learn more on this and digitizing the cash box: Event Information