A brighter future for the children

Mrs.Divya has been residing in Thanthoni village more than 11 years. She studied till 12th standard. Her husband Anantharaj is a two-wheeler mechanic, and they have two boys. Both the children are studying in a government school in Std. 4 and 5 respectively. Mrs.Divya works as a labourer in agriculture and her husband runs a small two-wheeler mechanic’s shop in a rented commercial building. Currently they are living in a small tiled and asbestos roofed house with electricity and other basic requirements.

She tells us, “When I got married, I didn’t have a proper house and there was no electricity in the house. We lived in a small hut, and I was mostly dependent on my husband’s small income. He did not have a proper place for his two-wheeler repair work and had a small temporary shop near the bus stand that was a highly congested area. The income that came from the shop was little and there were many hardships in our life.”

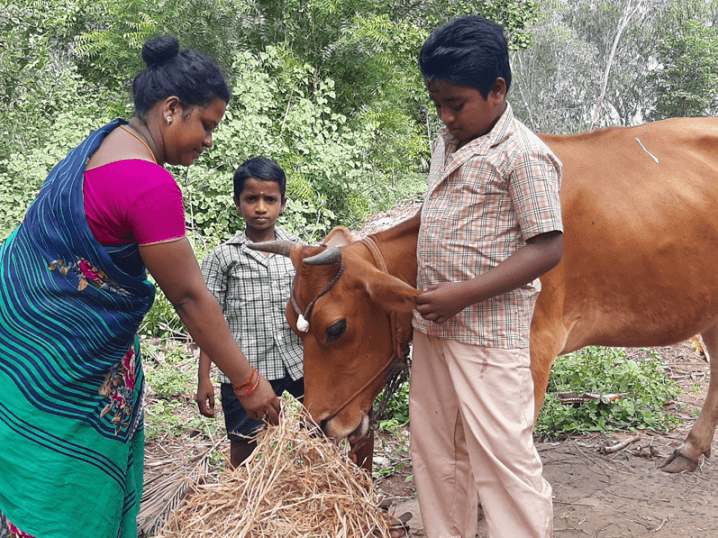

Her family members were not able to support her financially as they did not earn enough. While living in the village, she noticed that there was a shortage of cow’s milk although there was demand. People went out of the village to purchase milk. Based on this business opportunity, she decided to buy a cow but did not have enough money to purchase one. This is when she approached IMPACT, VisionFund’s office in India, for a loan as she attended a meeting by IMPACT that provided her good information on the loans. IMPACT provided her a loan and with that she was able to purchase a cow. The cow provided about five litres of milk that she sold to the local villagers both morning and evening. The family also has a few chickens that the children love. The eggs that they get from them are provided to the children so that they get proper nutrition.

As the income started coming to the family from two means, it was possible to do some saving. With the income she was able to take care of the needs of the children as they were very young. However, there were more requirements as the children started growing. She took another loan, bought one more cow, and further increased the family income. With the income earned, the children were provided nutritious food and she was able to take care of their educational requirements. She paid back the loan on time and took another loan, with which her husband was able to start a new shop and purchase the required tools for two wheeler repair.

She says, “We started to save money with the post office for both my children. These savings will give a brighter future to my children and the family.” She further says, “Our life has been revived due to IMPACT loans and currently we are able to manage our family with the income from the cows and mechanic shop. I am having big dreams for my children and I would take all efforts to provide them the best possible education. We would continue to take loans from IMPACT and grow in business and income. We feel our children would have a secure life and there is a bright future for them. We want our children to live in a good concrete house in future. This is because of the way that IMPACT has guided us and helped us in our business and provided us timely loans.”

Story by K.Arun, IMPACT, India