Reaching Underserved Populations in Myanmar

Reaching Underserved Populations in Myanmar

In one of VisionFund’s largest microfinance institutions (MFIs), an innovative financial inclusion approach is helping clients in underserved areas access much-needed finance across Myanmar.

Reaching Underserved Populations in Myanmar

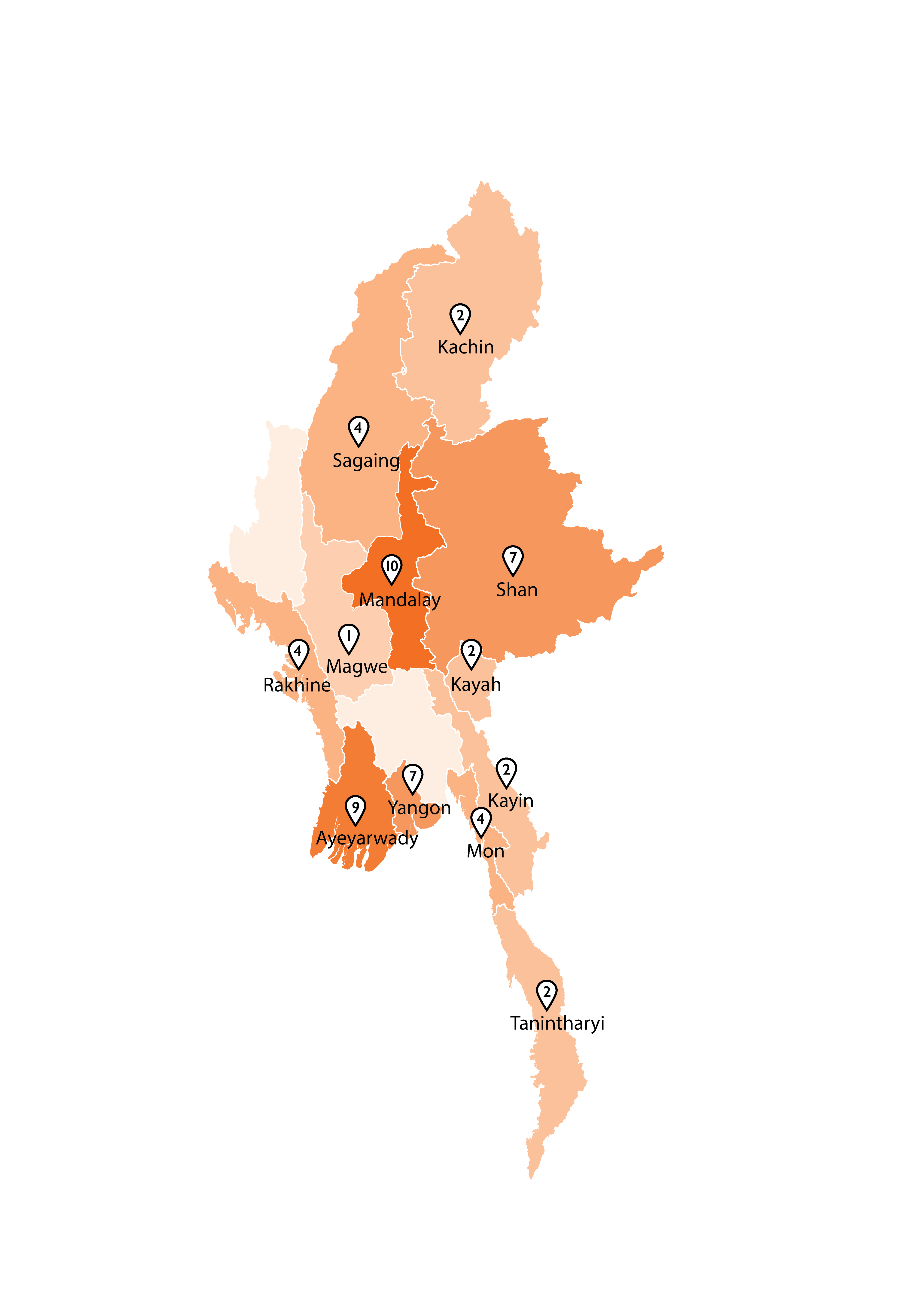

In Myanmar, VisionFund has over 50 branches supporting nearly 200,000 clients access financial products and services across the country.

In some rural areas in Myanmar, some communities are not able to access formal banking services though the government is supportive of economic development and affordable finance across the country. Bridging the gap, VisionFund is bringing financial services to underserved communities. Our work is specifically designed to support low income women and vulnerable populations such as garment factory workers, migrants, internally displaced persons (IDPs), people living in conflict-affected areas and rural areas, and smallholder farmers. By providing financial services to these populations, our clients are empowered with the tools and resources to sustainably support their families out of poverty in the long term, where they may have not had opportunities to do so before. VisionFund staff are committed to serving people to have better living standards across the country.

Number of Branches by Region

Reaching Underserved Populations in Myanmar

Conflict Sensitive Finance

In different parts of the country, people have difficulty accessing financial services due to active conflict and other challenges. With the support of partners and grant funding, along with innovative approaches in response to changes in the security context and risk level, VisionFund is ensuring that people living in conflict-affected areas such as Kachin, Shan, and Rakhine can access financial services and improve their livelihoods for themselves, their families, and their communities. VisionFund and its partners aim to sustainably reduce the number of people living in poverty and hunger in Myanmar through empowering rural and vulnerable households to increase their incomes, and build the resilience of households and communities to shocks, stresses and conflict.

Reaching Underserved Populations in Myanmar

Our Approach

VisionFund’s main approach is to channel loan disbursements through solidarity groups, which have between three and six group members on average. This methodology leverages existing social groups, which empowers women and other vulnerable groups to formally apply for credit, even when they don’t have credit histories or access to hard collateral.

Loan sizes depend on the business needs of the client and the client’s capacity to repay the loan, allowing the client to increase their loan sizes over subsequent loan cycles to meet the growing long-term credit needs of their expanding businesses. When vulnerable households have access to loan capital, they’re able to grow their businesses and turn a profit, allowing them to invest in the needs of their families, like school fees, nutritious food, and improved living conditions.

Reaching Underserved Populations in Myanmar

Empowerment Through Education

VisionFund also offers embedded client education and compulsory savings along with our loan products. Financial education helps to increase a client’s ability to responsibly manage their finances. Having savings also helps to build a client’s resilience and allows them to deposit their hard-earned money in a trustworthy institution, which provides interest to help them grow their savings over time. VisionFund will apply for a voluntary savings license in order to offer a wider range of savings products to support client business, personal and family financial goals.

Reaching Underserved Populations in Myanmar

Technology for Change

Our innovative approach leverages cloud-based technology to expand and deepen our social impact in Myanmar. Mobile technology will enable VisionFund to offer more products and services to clients through mobile wallets, including loans, savings, insurance, and client education through partnerships with third party providers. Mobile access increases convenience, security, and safety for both clients and staff. Through technology and innovation, VisionFund aims to transform from a financial service provider to a livelihood solution provider. This shift will not only link clients to financial products and services, but also to additional resources that will help people start and grow their businesses. We’ll be providing clients with access to resources such as digital literacy, agricultural information, market linkages, weather updates, business coaching, and even health and nutrition related information in the future.

Reaching Underserved Populations in Myanmar

From Risk to Prosperity

Some of our branches in conflict-affected areas will take longer to become profitable, given the insecurity of the context. VisionFund is keeping a close eye on security and regularly updates risk ratings for its operating areas in order to be responsive to changes in the context. This helps VisionFund communicate with clients affected by hostilities and reschedule loan repayments if active violence poses a threat to client or staff safety.

VisionFund is committed to managing our risk in efficient and sustainable ways. This commitment will allow us to provide access to the products and services that underserved and disadvantaged populations in the country need to secure their livelihoods, and to provide well for their children and families.