Delivering Refugee Microfinance in Uganda

Delivering Refugee Microfinance in Uganda

Providing savings group loans to refugee and host populations in Uganda means that families are rebuilding their lives, in VisionFund's one-of-a-kind microfinance project.

Delivering Refugee Microfinance in Uganda

The financial services community has long questioned how best to provide refugee populations with access to financial inclusion products.

Refugees are often seen as too risky to lend to, because they may not have documented credit history in their new country, and have few fixed assets or limited collateral. At the end of 2018, VisionFund participated in a UNHCR facilitated assessment to ascertain the capacity of existing refugee savings groups to access and use a savings group linkage loan, and in 2019, opened our first branch in Moyo to begin providing loans to refugees and host communities.

Delivering Refugee Microfinance in Uganda

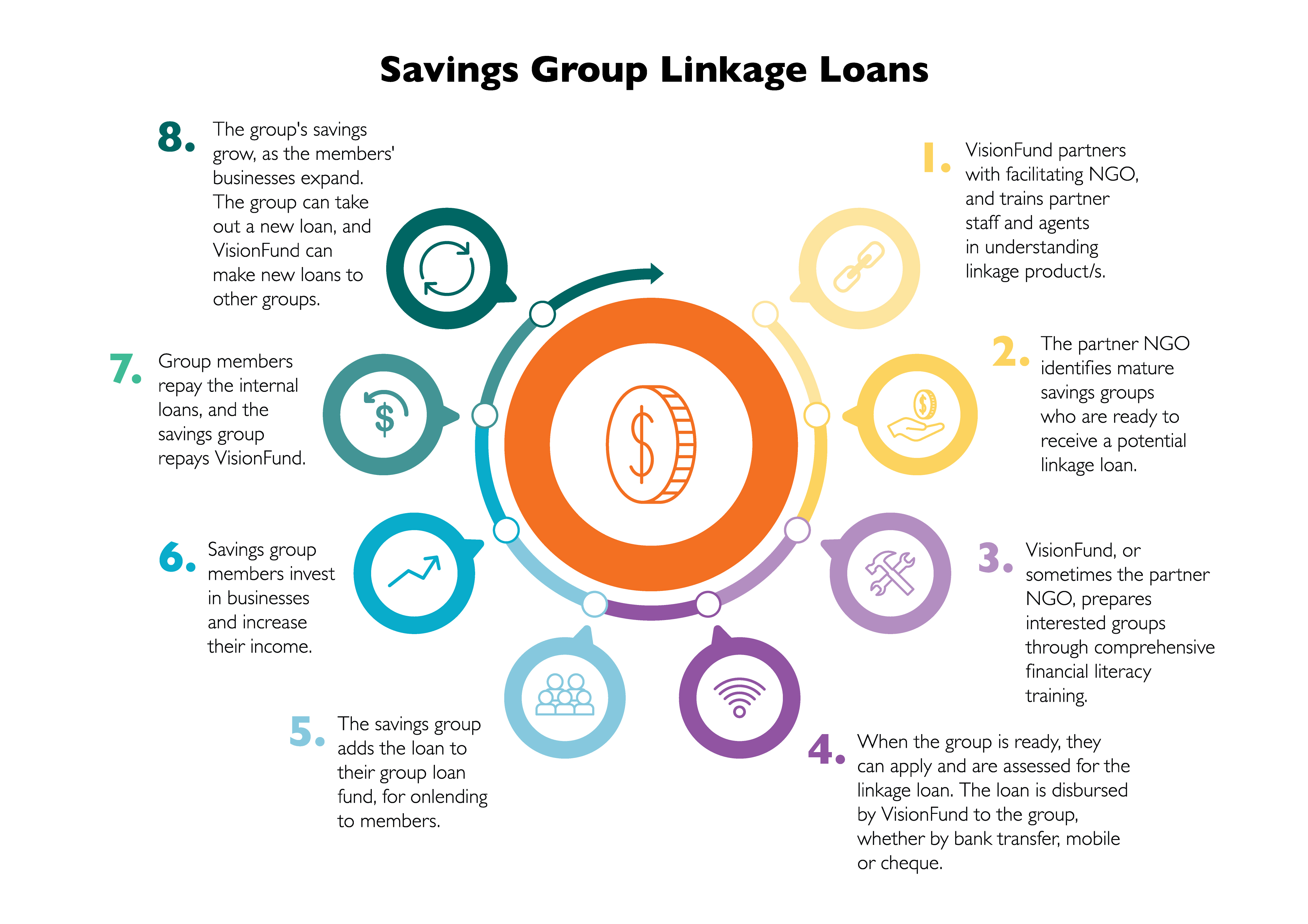

A Savings Group Loan provides a loan to the whole savings group, as an injection of cash to the overall pool of funds, usually kept in a locked box.

The group keeps following their savings and lending procedures, but with improved capacity to lend to the group members. This in turn helps members of the group to expand their economic activities, and generate a more stable income for themselves and their families. VisionFund Uganda is partnering with NGOs, such as World Vision, that support these savings groups to deliver the loans and provide financial services to refugee communities. VisionFund Uganda field officers help to assess, assist and monitor the group to help them pay back their loan.

Delivering Refugee Microfinance in Uganda

Technology plays a key role in our pilot to ensure the best client service and comfort for the savings groups.

Using mobile technology, savings groups are registered in the field, receive their loan and repay their loan using mobile money transfers. This means that group members don’t have to take valuable time and money out from their businesses to travel to a physical VisionFund branch: instead, we help support the groups to upskill in mobile technology in their communities, making financial access even easier.

Delivering Refugee Microfinance in Uganda

In May 2019, VisionFund Uganda opened their first branch in the town of Moyo, in West Nile.

The branch is staffed by newly trained field officers who were recruited from both host and refugee communities, so they understand local needs. In July 2019, the first loans were made to savings groups in Ukuni East Village after they were identified and trained by our staff. By June 2020, VisionFund is providing savings group loans to 80 savings groups representing 1,751 people, having disbursed USD$75,000 in loans.

Delivering Refugee Microfinance in Uganda

Over 3,000 individuals have been trained by VisionFund in financial literacy, 2,266 of whom are women.

Financial literacy training forms a cornerstone of our microfinance program for refugees, helping them to establish financial knowledge for their households and communities. Our Savings Group members in particular are able to manage their savings and pay out cycles more effectively, ensuring that their families and children are cared for in a difficult time.

Our Partners

Our work in the West Nile is made possible with thanks to our trusted partners.

With special thanks to our donors: Agriculture Business Initiative (aBi Trust), Austrian Development Agency, Grameen Credit Agricole, Financial Sector Deepening Trust Uganda, Financial Sector Deepening Africa, Swedish SIDA and UNHCR.

With special thanks to our partners in the field: CARE, Cheshire, CREAM, Danish Church Aid (DCA), Diocese of Kajo Keji, Mercy Corps, World Vision, ZOA and OPM (Office of the Prime Minister).

Impact of COVID-19 on Refugee Saving Groups

A study was conducted to understand the effect of COVID-19 on savings group (SG) on both host and refugee communities.

Report: Contextual and Financial Assessment of Savings Groups in West Nile, Uganda

The assessment report includes results and business opportunities in West Nile that merit providing financial services to host population and refugees, especially in those areas where there is currently limited or no presence of formal financial institutions.