page / September 26, 2023

Rwanda | Careers

At VisionFund Rwanda we are passionate about the power of innovative microfinance services to unlock people’s potential. Our staff are working hard to empower communities to thrive.

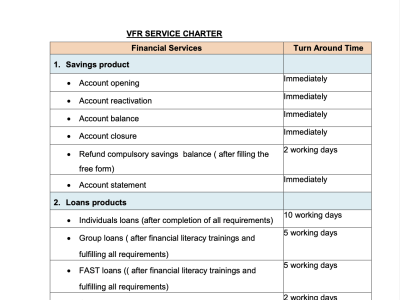

publication / September 26, 2023

VisionFund Rwanda Service Charter

VisionFund Rwanda's Service Charter

publication / February 13, 2024

State of the Practice: Savings Group Linkages 2024 Report

The 2024 State of the Practice Report, a groundbreaking study in the realm of financial inclusion, delineates the contemporary landscape of linkages between informal savings groups and formal financial services.

article / April 9, 2024

The Joint World Vision and VisionFund Ghana Field Trip to Fantseakwa AP.

The Boards of World Vision Ghana and VisionFund Ghana embarked on a three-day field visit to the Fanteakwa North and South District to observe ongoing impact activities undertaken by World Vision Ghana and VisionFund Ghana in the area.

publication / March 25, 2024

VisionFund Tanzania 60_Decibels FAST Initial Programme Client Survey Report

VisionFund commissioned 60_Decibels to conduct two impact evaluations in Tanzania to determine if VisionFund´s FAST programme – lending to savings groups, accomplished its main programme objectives:

publication / June 1, 2023

VisionFund Impact Evaluation: Savings Group Lending for VisionFund Rwanda

VisionFund is a learning organization and is committed to understanding the impact our products have on the lives of our clients and their families.

publication / January 22, 2024

VisionFund FY23 Impact Annual Report

VisionFund is proud to release the FY23 VisionFund Impact Annual Report with data ending September 20, 2023.